Financing in today’s world has become more important than ever. From fresh graduates to retirees, everybody is determined to manage their personal finances in the best way possible.

To make this process simpler, there are several emerging players in the market – and two such incredible ones are Kuvera and ETMoney!

Both platforms, though being in the same industry, largely differ from each other.

In our article, we will compare the two mutual fund and wealth management platforms critically to see the differences and similarities they have to offer!

What is Kuvera?

Kuvera is a wealth management app that vouchers to simply your wealth management process.

It does so by providing services like tracking direct mutual funds you invest in, international remittance support, family insurances, tracking stocks from your brokerage accounts such as Zerodha, digital gold, fixed deposits, and more.

Founded in 2016, it also supports cryptocurrency exchanges and U.S. ETF investments.

There is a special loan provision service that works on loans backed by an individual’s portfolio system.

Kuvera is here to provide you with everything finance-related under one roof – making things simpler, straightforward, and quick.

What is ETMoney?

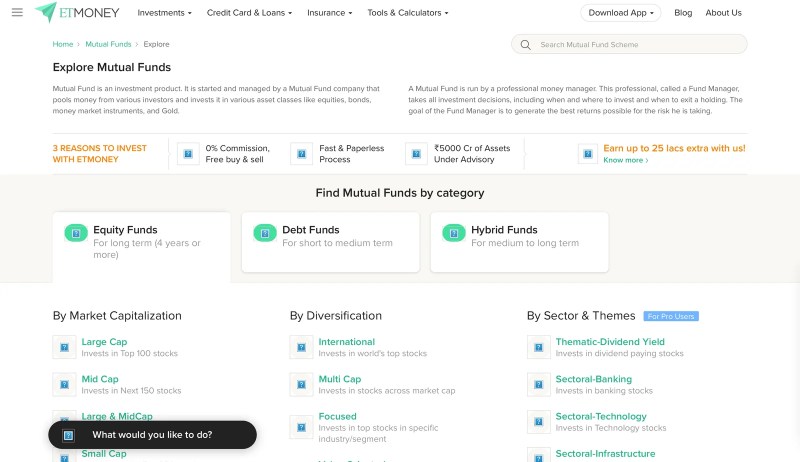

ETMoney is also a platform that offers products in the personal finance niche including but not restricted to SIP investments, direct mutual funds, NPS, health and term life insurances, and a lot more.

It is to simplify the digital finance journey of everybody in India, being the fastest-growing fintech platform in 2021.

It gives you the opportunity to invest in top AMCs, zero-commission mutual funds, and even switch your already existing investment products into direct plans.

ETMoney helps you choose the right fund aligning with your investment goals, objectives, and risk appetite to make sure that you make the most out of your money.

Kuvera VS ETMoney – A Comparison

PRODUCTS

Kuvera

Kuvera offers mutual funds, stock portfolio tracking, digital gold, ETFs, U.S. stocks, and a savesmart option to invest in liquid funds and trail annualized returns to save big!

All the products are available to invest in and track on all devices supported by iOS, Google, and Android.

There are several mutual fund plans you can choose from in Kuvera, but only direct ones – to save you up to 1.5% commissions.

There are over 40 leading fund industry houses including names like SBI, TATA, Motilal Oswal, and more.

ETMoney

ETMoney offers several products like mutual funds, NPS, fixed deposits, insurances, credit cards, loans, and more – all under one roof. It also offers a service for tracking bills and expenses that helps you remain on top of your spending and savings data.

It offers hundreds of schemes, tools, mutual fund AMCs, and calculators that help you up your finance management game.

From blue-chip funds, SIP calculators, debt mutual funds CAGR calculators to hybrid mutual funds, mutual fund NAV history and so much more – with ETMoney, you do not have to visit any other platform for anything wealth-related.

FEATURES

Kuvera

- It helps you save taxes through ELSS funds that have low lock-ins and easy withdrawals.

- It provides a holistic dashboard for your investments where you can see the top-rated funds, instant redeem funds, a complete watchlist, investor choice funds, new funds, tax-saving funds, and more.

- Kuvera helps you minimize the impact of your taxes on your income in the long term by releasing a maximum of Rs 1 lakh every year without tax.

- Helps you calculate your pre-tax gains, LTCG taxes, and taxable gains.

- Offers a TradeSmart service that helps you stay away from unnecessary commissions and also enables you to switch from past regular plans to direct plans

- It also offers family account opening systems that let you sign up with one account and manage investments in the website family through that account.

- It has an automatic tracking system that tracks the entire portfolio for you with high security.

- Kuvera also manages several accounts for you by letting you add your financial advisor to the account and get guided through your investments.

- Set goals on the Kuvera app and invest accordingly to achieve those goals as per your personal deadline

- Transfer money to friends and family that you invest in Kuvera cheaply, quickly and securely

- Proactive support team ready 24*7 to help you through any issue.

- They are SEBI-registered investment advisors who have the security level matching that of a bank.

- Includes an external investment tracking device

- It is India’s first free investment management platform. No strings attached

ETMoney

- ETMoney allows you to track all your investments in real-time.

- There is a comprehensive spreadsheet that tells you all about your investments and the money you have invested in each product

- The tools and calculators help you ease out the process of calculating important valuations around your finances.

- Does not require any account details, and passwords offer bank-level security

- It is transparent and lets you know about everything with sheer honesty through its actionable insights.

- Manage your money with 100% automation

- Does not involve any jargon in the process, making it simpler and quicker even for beginners

- Organize your savings, spending, bills, and investments without any input of your own. It includes over 10 important characters that help you calculate and analyze your SIPs, lumpsum amounts, HRA, NPS, CAGR, compound, and simple interest, and a lot more.

- There also exists a short-term return, annual mutual. Funds return, long-term return, and mutual fund monthly return calculator.

- Performance risk ratios, mutual fund NAVs, historical NAVs, and mutual fund comparisons are a few other tools that ETMoney has to offer.

- Offers flexible payout options

- Top rated platform by CRISIL FAAA and ICRA MAAA

- Higher returns than banks, assuring up to 7.05% on FDs

- Round the clock customer support

- Provides credit score for free in 30 seconds

RESOURCES

Kuvera

Kuvera has a separate dedicated section that provides its readers with news and financial advice. From managing accounts, SIPs to joining accounts, and more – you will find something about everything in their blog segment.

The articles are extremely helpful to beginners and also help finance experts become even stronger in their finance game. You can find all financial news and learnings on Kuvera in one click!

ETMoney

The special thing about ETMoney is that with all its products, it also provides informational insight around the product.

If you do not know what an RD is but wish to know about the same and invest, it is possible with ETMoney.

Whenever you click on any product on ETMoney, you will first be told what it is, the benefits, and which type of investor should invest in it.

This enables investors to make decisions about products they do not know much about and also helps them learn more financial terms every day.

Not only that, but they also offer a dedicated blog section that aims to inform, educate and make people aware of everything they need to know about finances.

Additionally, the tools and calculators that ETMoney has to offer are definitely a golden resource for every user on it.

USER INTERFACE AND EXPERIENCE

Kuvera

Kuvera has a simple and clean user interface, providing users with a seamless experience across Kuvera.

It comes with a two-factor authentication setting to ensure security and links your external accounts with one click.

This makes it beginner-friendly as well, as it does not use any technical jargon around the app.

All the products have a dedicated page, and even specific tools and calculators are all mentioned in ways that are simple to understand without any confusion.

The clean user interface ensures that the information is not too much to consume but is enough for a person to feel productive within the first few minutes of reading the content.

ETMoney

We especially love ETMoney’s interface because of how comprehensive yet easy to understand it is.

It comes with built-in pages that are dedicated to each product and service, which does not only talk about the product but educates the user about it.

Each page consists of what the product is, its benefits, why one should invest in it, and so much more.

Even though the calculators come with analytical insights, they are not hard to understand by even beginner users.

It is absolutely okay if you are the average person in the finance field because ETMoney never uses any technical jargon, and if it does, it ensures to first educate you about it before moving forward.

Everything on ETMoney is self-explanatory, giving investors an incredible user experience.

RETURNS

Kuvera

Kuvera assures returns of more than 6% on fixed deposits, higher than what most banks provide.

Also, it adds up to your return on investment in mutual funds, stocks, ETFs, and other products by forgoing any commissions in the process.

You can earn the highest returns in the equity index by investing in companies suggested by Kuvera and enjoy the balanced advantage approach of it.

In this approach, Kuvera helps you allocate your money smartly in both debt and equity through a single fund, maximizing your returns and minimizing losses.

ETMoney

ETMoney helps you earn up to more than 1% more than your regular income from investments through their 0% commission policy.

It offers over 20% 5-year returns on its SIP investments by helping you choose the right fund for your investment goals.

Through ETMoney’s national pension scheme, you can save up to Rs 62,400 in taxes every year. Not only that, it offers up to a 7.05% return on fixed deposits, which is higher than what any bank in India provides.

LOAN

Kuvera

Kuvera offers loans to its users against their mutual fund investments.

You can get up to 80% loan of your mutual fund’s current market value by Kuvera digitally in less than 3 minutes. Kuvera launched this service to provide its users with instant liquidity.

The interest rate applicable on the loan is lower than most of the credit cards and personal loan interest rates prevailing in the country.

ETMoney

ETMoney provides personal loans with interest rates that start at 11.99% and differ according to the loan amount. A user can take up to 20 lakh rupees as a loan from ETMoney with an overdue interest rate of 0.75% applicable every month if not repaid in time.

PRICING

Kuvera

Kuvera platform is absolutely free to use and download. It does not require any hidden charges or commissions whenever you invest in a product.

Sometimes, Kuvera offers coins when you refer them to a friend, and in return, you can avail of their exclusive services by paying through the coins.

If the friend(s) you referred the app to invests more than Rs 5,000 through Kuvera, the app gives you Rs 201 worth of digital gold!

ETMoney

ETMoney is also an absolutely free-to-use app that you can download without any hidden charges.

All the tools, calculators, investments, and redemptions are free to use.

The calculators come with a comprehensive analysis of all the amounts you put in, giving you valuable insights into your financial situation without spending even a single penny.

Conclusion

Both apps have their own features and services that are useful for an investor seeking financial assistance.

While Kuvera offers great wealth management services along with a loan of up to 80% of your mutual fund value, ETMoney is rich in finance tools and tax savings.

Since both the apps are free to use, it is definitely worth a try to experience both of them first hand!

If you enjoyed this article, I recommend checking out our article on Top 5 Investment Apps In India for Beginners.

I think Kuvera is better for investing as it offers a higher interest rate than ETmoney.